|

| BANK RELATED DOCUMENTS |

A Bank Guarantee is a financial instrument issued by a bank confirming that full payment will be made by the issuing bank when conditions stipulated in the (SPA Procedure) Sale and Purchase Agreement procedure are met. The holder can borrow against it or secure a higher line of credit based on the value of the instrument.(BG):

A Bank Guarantee is a financial instrument issued by a bank confirming that full payment will be made by the issuing bank when conditions stipulated in the (SPA Procedure) Sale and Purchase Agreement procedure are met. The holder can borrow against it or secure a higher line of credit based on the value of the instrument.

|

| Bank Guarantee (BG) |

2. Bank Comfort Letter (BCL):

A Bank Comfort Letter is unlike a Bank Guarantee. It rather states the financial position of the account holder, (the Buyer). It cannot be cashed or borrowed against, nor can it be used to increase the holder’s credit line. BCL is not a valid financial instrument.

|

| Bank Comfort Letter (BCL) |

3. Documentary Letter of Credit (DLC):

A Documentary Letter of Credit is a financial instrument issued by a bank and payable at full face value upon successful production of the required documentation as contained in the body of the document (DLC). When the required documents are tendered and verified by the issuing bank, payment will be transmitted to the recipient’s bank by swift within the number of hours or days as specified in the contract procedure.

|

| Documentary Letter of Credit (DLC) |

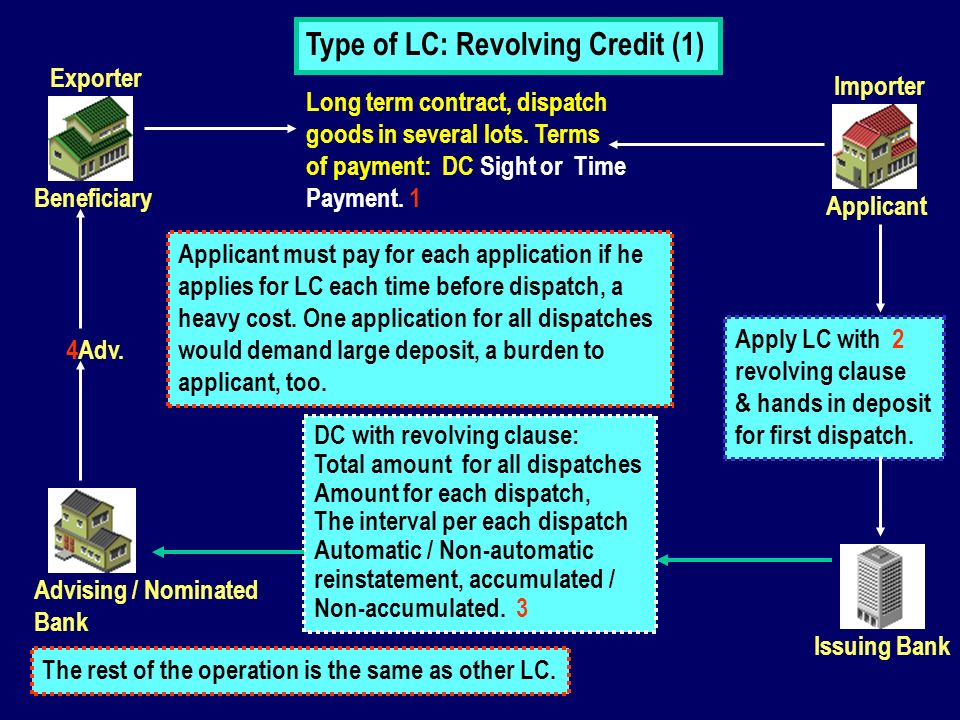

4. Revolving Documentary Letter of Credit (RDLC):

RDLC is the same thing as DLC but revolves around the life of the contract.

|

| Revolving Documentary Letter of Credit (RDLC) |

5. Bank Pre-Advice:

A Pre-Advice is a document sent by a bank advising the recipient’s bank about her intention to open a financial instrument. For example, bank “A” will send a notice to bank “B” about her readiness to open a DLC in favour of the seller who is a customer of the bank, Bank B. Bank B will respond confirming her readiness to receive such financial instrument on behalf of her customer.

|

| Bank Pre-Advice |

6. Soft Probe:

A soft probe is a means by which a bank conduct a brief credit worthiness of a customer and also confirm if that customer’s account is in good standing. It could be summarized as a “light credit check”.

|

| Soft Probe |

7. SWIFT:

SWIFT is the coded means by which banks transfer funds and documents through wire process. What Is SWIFT? SWIFT is the Society for Worldwide Interbank Financial Telecommunications. This organization operates a closed network which operates between banks and financial institutions for the purposes of exchanging messages relating to financial information. SWIFT was founded in Brussels, Belgium, in 1973 at a time when it was fast becoming apparent that globalization was a major market force, but banks in various countries were having trouble keeping up with the emerging demand for quickly and efficiently sending money and communicating financial information across borders. When it was first founded, the SWIFT network operated in just fifteen countries and had less than 300 banks and financial institutions associated with its network. Nowadays SWIFT operates in 208 countries and there are well over 8,000 banking institutions who make use of the SWIFT messaging network. SWIFT Codes SWIFT codes are simply a means of differentiating between different kinds of SWIFT messages. The SWIFT messaging network operates using a series of standardized message types. In order to send a SWIFT message, the banking officer simply fills in the appropriate information in the appropriate fields, and sends the message. In order to identify the different types of SWIFT message, there are numbers assigned to each of them. The ‘MT’ prefix stands for ‘Message Type’, and the three digit number that follows it represents a specific message type.

|

| SWIFT |

8. SWIFT CODE MT760

The MT760 is a type of SWIFT message that is sometimes requested in trading because it functions much like a Bank Guarantee. Essentially, a MT760 is a SWIFT message which guarantees that a bank will make payment in favour of a client of another bank. When a MT760 is issued, the issuing bank puts a hold on its client’s funds, thereby ensuring that the funds are in place to make payment to the recipient of the MT760.

|

| SWIFT CODE MT760 |

The main difference between the MT760 swift message and the MT799 swift message is in when they are sent. The MT799 is sent before the MT760 and is a prelude to the sending of the MT760. Hence, the role of the MT799 is merely to notify and nothing else. This document is sent days or weeks before the sending of the MT760. It is important to note that the MT799 has no impact on the financial situation of an individual. This is another big difference that exists between the two documents.

The MT760 swift message will impact the financial condition of a client since it a verification of freezing of funds by one bank. The MT799 swift message will have no impact on the financial situation of an individual since it is sent before the funds are frozen. This is another difference between the two documents. Another difference between the two documents is that theMT760 swift is sent after the sending bank has set aside the required amount of money. The MT799 is sent before the sending bank freezes the required amount of money in the purchasing individual’s bank account.

9. SWIFT CODE MT799

The MT799 is a free format SWIFT message type in which a banking institution confirms that funds are in place to cover a potential trade. This can, on occasion, be used as an irrevocable undertaking, depending on the language used in the MT799, but is not a promise to pay or any form of bank guarantee in its standard format. The function of the MT799 is simply to assure the seller that the buyer does have the necessary funds to complete the trade. The MT799 is usually issued before a contract is signed and before a letter of credit or bank guarantee is issued. After the MT799 has been received by the seller’s bank, it is then normally the responsibility of the seller’s bank to send a POP (proof of product) to the buyer’s bank, at which point the trade continues towards commencement.

10. SWIFT CODE MT700

MT 700 is a swift message type that is used by issuing banks when opening a letter of credit, this swift message is sent by the issuing bank to the advising bank, it is used to indicate the terms and conditions of a documentary credit which has been originated by the Sender (issuing bank), according to latest UCP rules, UCP 600, unless otherwise specified, a documentary credit advised to the beneficiary or another advising bank based on a SWIFT message constitutes an operative credit instrument which means that MT 700 swift message is an operative letter of credit. No written message need to follow, the advising bank must advise a documentary credit, including all its details, in a way that is clear and unambiguous to the beneficiary.

11. SWIFT CODE MT103

SWIFT MT-103’s is the most commonly used form of SWIFT communications, and one which many people will have utilized without even knowing it. For most bank customers, they are known not as MT-103’s at all, but rather as wire transfers, telegraphic transfers, or SWIFT transfers. A SWIFT MT-103 is used by the bank when its customers wish to make payment to customers of another bank in another country.

The MT760 swift message will impact the financial condition of a client since it a verification of freezing of funds by one bank. The MT799 swift message will have no impact on the financial situation of an individual since it is sent before the funds are frozen. This is another difference between the two documents. Another difference between the two documents is that theMT760 swift is sent after the sending bank has set aside the required amount of money. The MT799 is sent before the sending bank freezes the required amount of money in the purchasing individual’s bank account.

9. SWIFT CODE MT799

The MT799 is a free format SWIFT message type in which a banking institution confirms that funds are in place to cover a potential trade. This can, on occasion, be used as an irrevocable undertaking, depending on the language used in the MT799, but is not a promise to pay or any form of bank guarantee in its standard format. The function of the MT799 is simply to assure the seller that the buyer does have the necessary funds to complete the trade. The MT799 is usually issued before a contract is signed and before a letter of credit or bank guarantee is issued. After the MT799 has been received by the seller’s bank, it is then normally the responsibility of the seller’s bank to send a POP (proof of product) to the buyer’s bank, at which point the trade continues towards commencement.

10. SWIFT CODE MT700

MT 700 is a swift message type that is used by issuing banks when opening a letter of credit, this swift message is sent by the issuing bank to the advising bank, it is used to indicate the terms and conditions of a documentary credit which has been originated by the Sender (issuing bank), according to latest UCP rules, UCP 600, unless otherwise specified, a documentary credit advised to the beneficiary or another advising bank based on a SWIFT message constitutes an operative credit instrument which means that MT 700 swift message is an operative letter of credit. No written message need to follow, the advising bank must advise a documentary credit, including all its details, in a way that is clear and unambiguous to the beneficiary.

|

| SWIFT CODE MT700 |

SWIFT MT-103’s is the most commonly used form of SWIFT communications, and one which many people will have utilized without even knowing it. For most bank customers, they are known not as MT-103’s at all, but rather as wire transfers, telegraphic transfers, or SWIFT transfers. A SWIFT MT-103 is used by the bank when its customers wish to make payment to customers of another bank in another country.